Rising costs in the UK push more than half of disabled households into debt

- First research since the government announced its package of support for households reveals disabled people and family carers are at breaking point, and cost of living payments will only offer temporary relief

- Disabled households already face higher living costs – paying more for essential goods and services, and with prices rising, more than half (54%) say they are in debt, with more than a third (38%) skipping meals to save money

- Nearly three quarters of family carers (74%) say that if prices continue to rise, they will be unable able to cope, with more than two thirds (68%) saying the pressure is affecting their mental health.

- The disability charity, Sense, who conducted the research, are calling for long-term financial support for disabled people and families, including the reinstatement of the Warm Home Discount and an urgent increase to benefits, to bring them in line with inflation

22 June 2022 – One in two (54%) disabled households* in the UK have been pushed into debt due to rising costs, with more than a third (38%) now skipping meals to save money. That’s according to new research by the national disability charity Sense, which reveals the financial pressure on family carers and disabled people, amidst the current cost-of-living crisis.

Over 2,000 people were surveyed** by Sense, including one thousand disabled adults and one thousand families caring for a disabled child or adult in their household. The research, the first since the Government announced its package of support to help people struggling with rising prices, reveals that four out of five (81%) disabled households do not believe the measures go far enough.

Three out of five (64%) households said they now face difficult decisions, like choosing between heating the home and buying food to eat, with one in four (28%) carers taking on, or are looking for, additional work. Nearly three quarters (74%) said that if prices continue to rise, they will be unable able to cope, with more than two thirds (68%) saying the pressure is affecting their mental health.

Disabled people and carers already face higher living costs. Households must buy specialist equipment and use more energy for vital services like extra washing, charging wheelchairs and powering oxygen machines. Transport costs are often higher due to a reliance on taxis or adapted vehicles. And for many, working full time is not an option, while others are locked out of employment because of caring responsibilities.

Last month, the Government said that it recognised the pressure on disabled households and announced a one-off disability cost of living payment of £150, with disabled people who fall into the lowest income bracket, receiving an additional payment of £650, taking their total cost-of-living payments to £800. The measures were broadly welcomed, but the concern is that it will only bring temporary relief.

Sense is calling for long-term financial support for disabled people and their families. This includes reinstating eligibility for the Warm Home Discount, which currently excludes around 210,000 people on disability benefits from applying.

Sense also wants to see benefits urgently increased in line with inflation. In April, Universal Credit and other benefits rose by 3.1%, in line with the CPI rate of inflation last September. Yet, in May, inflation hit a 40-year high of 9% in the 12 months to April, and the Bank of England forecast it will be 11% by autumn.

Richard Kramer, Sense Chief Executive, said:

“The research highlights the desperate everyday reality of disabled households across the UK, who are in debt and facing impossible decisions such as whether to eat or heat the home.

“Everyone is affected by rising prices, but disabled households are one of the hardest hit because of their circumstance. Many are in poverty, less likely to be in full-time work and facing additional costs for essential goods and services, like charging the wheelchair or running the oxygen machine. With social care services cut, many families already struggle to get the support they need and feel there’s no way out of their financial situation.

“The costs disabled people and families face are not luxuries that can be cut, and ‘improved household budgeting’ will not solve the problem. Disabled people and carers need long-term financial support.”

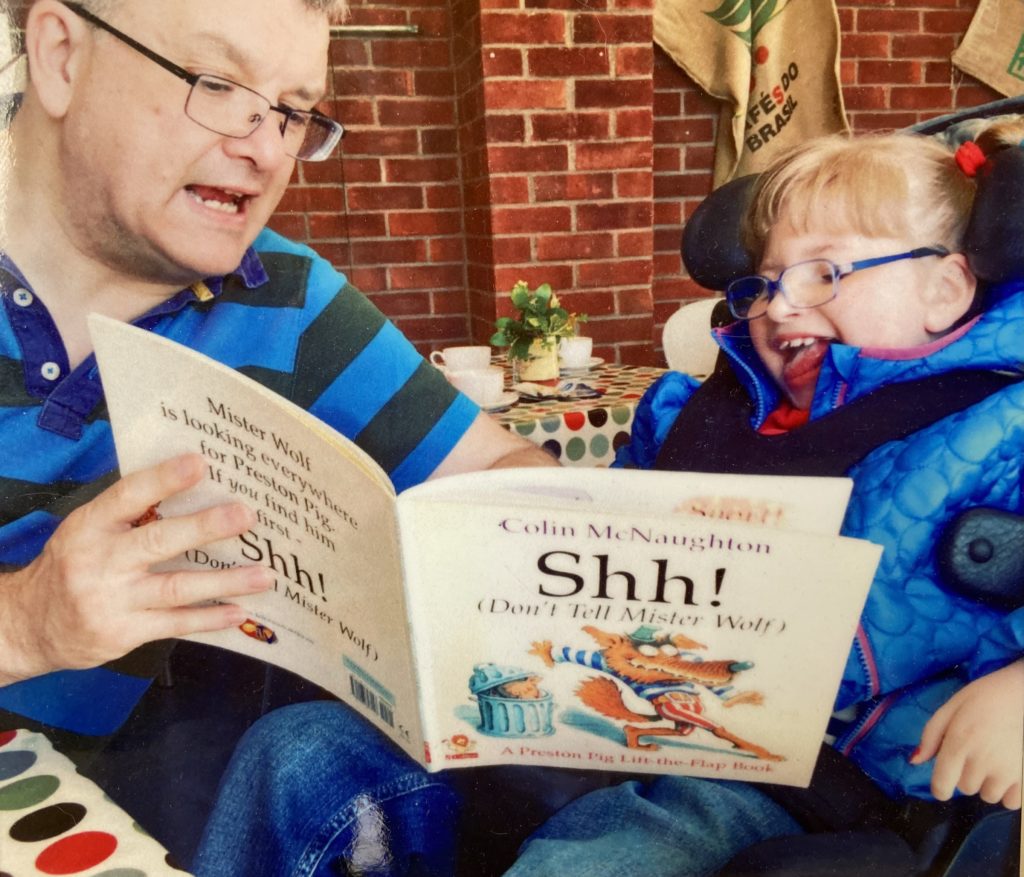

Nick’s story:

Nick Flaherty from Bristol cares for his 13-year-old daughter Rhia. Rhia has a metabolic condition called PDH which is life limiting and she is registered deaf and blind. The family’s debt has been getting worse as costs have been rising.

Nick said: “We have a lot of additional costs. Rhia uses a ventilator and nebuliser that use up energy, and as she receives night-time care we have to keep the lights and heating on for carers. We also have to run several washes a day, as Rhia is double incontinent.

“It’s a lot and we were in debt even before prices went up, this is just going to push us further into debt. We were already under water, now we’re drowning. We have the same level of support now that we had when Rhia was three, so our support has been slashed in real terms over the last decade.

“The £150 from government is great but it’s tiny compared to the thousands of pounds in energy costs we’re facing on top of the debt we’re already in.

“I constantly worry but the worry pales into insignificance when the alternative is your child dying. You just don’t have a choice.”

Contact Sense’s media team

Email: [email protected]

Phone number: 0203 833 0611